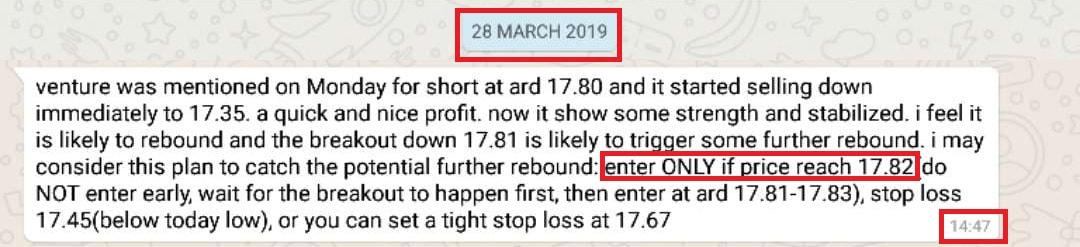

Venture was mentioned for long on 28 March morning at ard 17.82. It moved up thereafter and reached 18.84 after 3 trading days,up 5.7% within 4 trading days. If one use DLC to trade(https://dlc.socgen.com/en/product/terms/code/DLAW) with leverage, the potential profit will be 28%, not in 3 month, not in 1 month, but within 4 trading days only.

From the chart above, we can see that after the quick move, it hits a strong resistance zone at ard 19-19.5 level , which is strong and also quite broad, not easy for price to break above easily. we can see that buyers attempted to push higher for 2 days but profit taking took place and sellers manage to create some pull back regardless the strength of STI which went up 31.5 points, or 0.96.

Above is screenshot of my trading call made on 28 March, last Thur.

Whether Venture can go up even higher thereafter? How to operate thereafter?

If we look at big chart pattern of Venture below, we will find that it is recovering from a severe sell down from April to Dec 2018. Although it recovered a lot since 2019, uptrend may not established yet, the breakout out of strong resistance at 19.45-19.5 and form a inverse head and shoulder pattern may be a better confirmation of an uptrend. With this view in mind, I won't be very confidence whether venture will keep going up later.

In addition, the comparative weakness of Venture also worth taking note: when STI up 31.5 or 0.96% on wed, venture did not manage to make new high. it had some sell down instead. This may indicates that buyers are not determined to push price even higher and the stock may have some consolidation thereafter.

In addition, mkt has moved a lot in the past 3 trading days, so is kind of overbought now, STI may pull back soon. to chase a stock right below resistance at this moment may not be a profitable option

In addition, mkt has moved a lot in the past 3 trading days, so is kind of overbought now, STI may pull back soon. to chase a stock right below resistance at this moment may not be a profitable option

With above reasons in mind, I would rather NOT to bet on where the price is heading at this moment. Take profit maybe a better strategy for the time being. Of course we can still monitor venture after taking profit. If price manage to breakout 19.50 later, we can look out to long venture again or open position upon breakout.

Some investors missed this trading opportunity for Sarine with good potential profit, some investors may feel challenging in monitoring the price action and catch the next low risk trading opportunity, for Sarine and other stocks. If you encounter similar challenge in the market.....

RSS Feed

RSS Feed