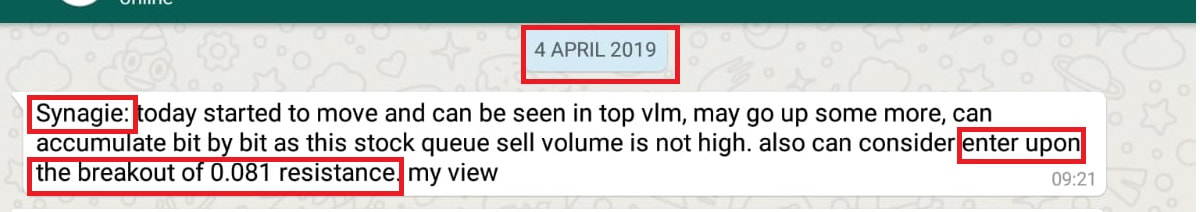

Synagie was mentioned for long at 0.082 on 4 April in the morning. After the call, price shot up 20% within the same day. Then, it went up 78% within 2 weeks. Both intraday traders and contra players made nice profit.

Screenshot of my trading call for Synagie is shown below, sent out on 9:21AM 04 April, BEFORE further movement was made:

Now Synagie pull back to ard 0.100 level, Whether it is a good opportunity to enter again? How to operate thereafter?

I feel it is an opportunity, the pull back is quite deep already, short term oversold, technically Synagie is likely to have some tech rebound soon and it can be quick and fast.

However we have to take note that it is dropping now, to buy on weakness involves high risk. Many market participants, no matter retailers or institute investors (like Temasek invested in Citigroup) has been hurt by catching falling knife.

I feel for Synagie, it may drop a bit more, but not so likely to drop below 0.080-0.082 again, which is a good support. We also know that the market is bullish now, increase the probability for rebound. Although this stock is volatile, we are not able to predict how it will move accurately, has to monitor and act accordingly. One can wait for it to stabilized and enter then. while for those who can take some risk can start accumulating PARTIALLY, at ard 0.101 or below, but must start small and increase position sizing gradually if price drop further.

However we have to take note that it is dropping now, to buy on weakness involves high risk. Many market participants, no matter retailers or institute investors (like Temasek invested in Citigroup) has been hurt by catching falling knife.

I feel for Synagie, it may drop a bit more, but not so likely to drop below 0.080-0.082 again, which is a good support. We also know that the market is bullish now, increase the probability for rebound. Although this stock is volatile, we are not able to predict how it will move accurately, has to monitor and act accordingly. One can wait for it to stabilized and enter then. while for those who can take some risk can start accumulating PARTIALLY, at ard 0.101 or below, but must start small and increase position sizing gradually if price drop further.

Some investors missed this trading opportunity for Synagie with good potential profit, some investors may feel challenging in monitoring the price action and catch the next low risk trading opportunity, for Synagie and other stocks. If you encounter similar challenge in the market.....

RSS Feed

RSS Feed