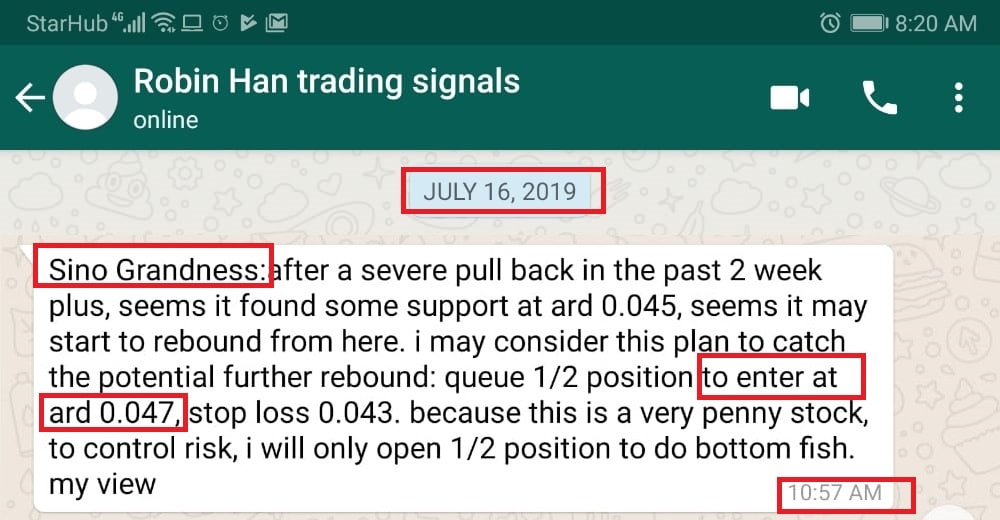

Sinograndness was called for long one week ago on 16 July at 0.047. This time it did not started moving immediately as many other calls I made. But after some consolidation, it still started to run on 19 July and reached 0.053 ystday(22 July), a quick move of 12.7% within 5 trading days, fast enough to do a contra trade, meaning we don’t need to make payment but can enjoy the potential profit from the move.

Click here to learn how to catch fast moving stocks.

Above was the live trade call made, BEFORE the nice move started, via whatsapp.

Now what should we do next for Sinograndness?

For those who want to do short term trading, a quick move of 12.7% is not bad already, after Sinograndness formed long tail on the upside, we can tell that it encounter some resistance ahead, short term traders may consider get out first on strength.

For those who don’t have Sinograndness position or look for long term operation, we should look at long term trend of the stock together with some fundamental factors. From the big chart pattern of Sinograndness, it seems that it is forming some bottom pattern. Although no one can guarantee it won’t drop below the recent low at around 0.040, the probability is not so high as the support is very significant, many investors will buy sinograndness if price drop to around 0.040 again. Besides, as SGX intend to scrap the minimum trading price(MTP) requirement for Mainboard-listed companies, it is positive to penny stocks because penny stocks has better chance to return to main-board. We can tell that many penny stocks had nice move recently, partly because of SGX’s intention to remove MTP requirement. Being a catalyst penny stock, Sinograndness is likely to be affected positively and not so likely to have severe sell down within certain period of time.

Now what should we do next for Sinograndness?

For those who want to do short term trading, a quick move of 12.7% is not bad already, after Sinograndness formed long tail on the upside, we can tell that it encounter some resistance ahead, short term traders may consider get out first on strength.

For those who don’t have Sinograndness position or look for long term operation, we should look at long term trend of the stock together with some fundamental factors. From the big chart pattern of Sinograndness, it seems that it is forming some bottom pattern. Although no one can guarantee it won’t drop below the recent low at around 0.040, the probability is not so high as the support is very significant, many investors will buy sinograndness if price drop to around 0.040 again. Besides, as SGX intend to scrap the minimum trading price(MTP) requirement for Mainboard-listed companies, it is positive to penny stocks because penny stocks has better chance to return to main-board. We can tell that many penny stocks had nice move recently, partly because of SGX’s intention to remove MTP requirement. Being a catalyst penny stock, Sinograndness is likely to be affected positively and not so likely to have severe sell down within certain period of time.

Next strong resistance level is ard 0.065-0.067, still have good potential from current level. If Sinograndness pull back further, may consider accumulate gradually and expect share price to go up some more after pull back and consolidation.

Besides, the recent share placement at 0.040(announced end of March) also help to form a strong support at this level

From fundamental perspective, according to the full year report announced on 1 March, the profit in 2018 dropped ard 10%, but not significant. While PE already drop to 0.78 and current price is only 0.078 time NAV. These numbers seems too low already but many Singapore penny stocks has dropping like this, like Rex, Krisenergy, Ausgroup, etc. Since the price is stabilized already, seems Sinograndness has good chance to turn back to a better price level.

Therefore for long term investors, may consider accumulate gradually, especially when sinograndness pull back. Once SGX really remove MTP, Sinograndness is likely to go up some more

Sinograndness is releasing financial report on 29 Aug, still have enough time to trade/invest without the uncertainty from release of financial report.

In short, I feel this is how to operate Sinograndness :1. Short term can consider take profit gradually on strength. 2. If price pull back deep, traders can accumulate gradually and expect price to have some rebound, or may even move much higher. 3. Long term investors may also accumulate and expect price to form a long term uptrend thereafter 4. But this is a penny stock just had a nice move, risk and volatility is high, position sizing is important and better start accumulating from small position so one can control risk well

Besides, the recent share placement at 0.040(announced end of March) also help to form a strong support at this level

From fundamental perspective, according to the full year report announced on 1 March, the profit in 2018 dropped ard 10%, but not significant. While PE already drop to 0.78 and current price is only 0.078 time NAV. These numbers seems too low already but many Singapore penny stocks has dropping like this, like Rex, Krisenergy, Ausgroup, etc. Since the price is stabilized already, seems Sinograndness has good chance to turn back to a better price level.

Therefore for long term investors, may consider accumulate gradually, especially when sinograndness pull back. Once SGX really remove MTP, Sinograndness is likely to go up some more

Sinograndness is releasing financial report on 29 Aug, still have enough time to trade/invest without the uncertainty from release of financial report.

In short, I feel this is how to operate Sinograndness :1. Short term can consider take profit gradually on strength. 2. If price pull back deep, traders can accumulate gradually and expect price to have some rebound, or may even move much higher. 3. Long term investors may also accumulate and expect price to form a long term uptrend thereafter 4. But this is a penny stock just had a nice move, risk and volatility is high, position sizing is important and better start accumulating from small position so one can control risk well

Some investors missed Sinograndness nice move, some investors may feel challenging in stock pick and price monitoring to catch nice great trading opportunities, like Sunmoon and other stocks (click here to read other trading calls made). If you encounter similar challenge in the market......

RSS Feed

RSS Feed