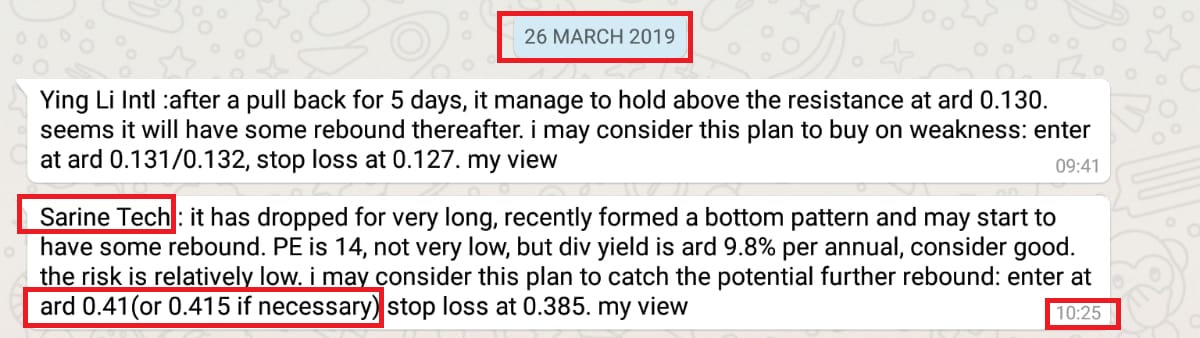

Sarine was mentioned for long on 26 March morning at ard 0.415. It moved up the same day and reached 0.495 the next day, up 19.2% within 24 hours.

From the chart above, we can see that after the impulsive move, it hits a strong resistance at ard 0.495-0.500 level , which is a strong resistance level. we can see that buyers attempted to push above this level for 2 days but profit taking took place and sellers manage to push down to 0.465.

Above is screenshot of my trading call made on 26 March, last Tue, right before the jumping of the price.

Whether Sarine can go up even higher thereafter?

It seems that Sarine is in an uptrend already. it has a good chance to continue the uptrend for some time. From the chart below we can see that it has been dropping for 1 year plus(Shown in the chart below). Once the uptrend is confirmed, we may expect the trend to continue for some time, if current bullish market does not have a sharp reversal.

Mid term wise, Sarine may go up to 0.58 first, followed by 0.65. It is also possible that the uptrend grow to a long term one and price climb even higher to above 0.7 if it announced more good news in terms of fundamental perspective.

However, short term wise, as price shot up so much just within 2-3 trading days, Sarine is quite overbought now. it may not be a good timing to open a new position immediately. Those who have it, may consider to sell partial to pocket in some profit.

But Sarine still worth monitoring in the next 1-2 weeks, if it has some deeper pull back, maybe to ard 0.45 level, or form some pattern to indicates the end of pull back, one may consider enter it again. Just that it is a fast moving stock now, may need time to monitor the price action and also need good timing skill.

However, short term wise, as price shot up so much just within 2-3 trading days, Sarine is quite overbought now. it may not be a good timing to open a new position immediately. Those who have it, may consider to sell partial to pocket in some profit.

But Sarine still worth monitoring in the next 1-2 weeks, if it has some deeper pull back, maybe to ard 0.45 level, or form some pattern to indicates the end of pull back, one may consider enter it again. Just that it is a fast moving stock now, may need time to monitor the price action and also need good timing skill.

Some investors missed this trading opportunity for Sarine with good potential profit, some investors may feel challenging in monitoring the price action and catch the next low risk trading opportunity, for Sarine and other stocks. If you encounter similar challenge in the market.....

RSS Feed

RSS Feed