Yzj suffered severe sell down during late July to early August. The price dropped from 1.5 to 0.75, literally cut half, many investors/traders got hit severely by the bad news.

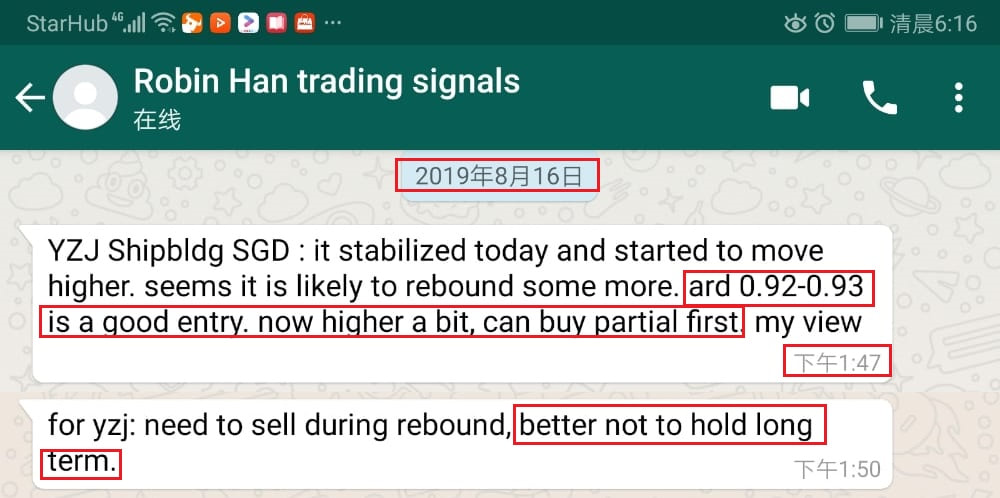

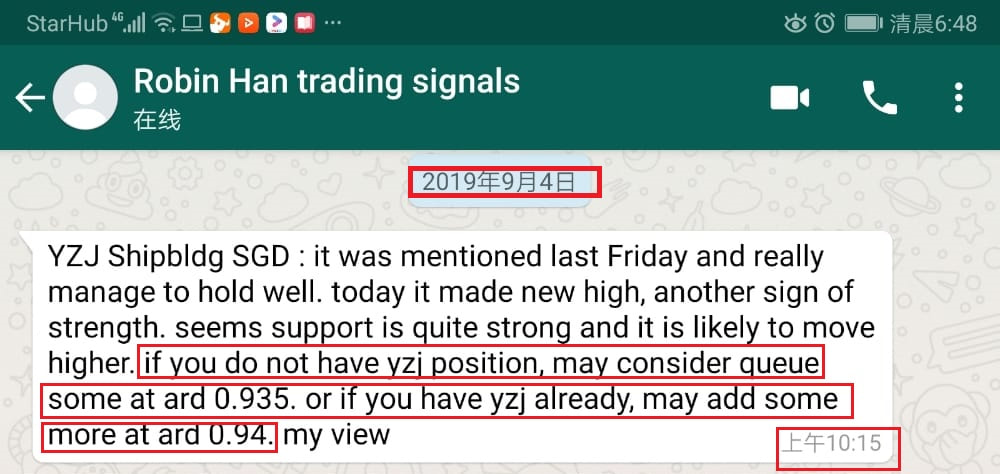

Based on Game Theory, I and my fellow traders manage to avoid this severe sell down, and fortunately manage to caught low risk entry for 2 times: on 16 Aug(at ard $0.95) and 4 Sept(at ard $0.94). Both of my calls was sent out via whatsapp so that fellow traders can react on spot instead of miss the great timing.

Based on Game Theory, I and my fellow traders manage to avoid this severe sell down, and fortunately manage to caught low risk entry for 2 times: on 16 Aug(at ard $0.95) and 4 Sept(at ard $0.94). Both of my calls was sent out via whatsapp so that fellow traders can react on spot instead of miss the great timing.

As shown in the chart above: For the first signal on 16 Aug, price shot up from $0.95 to $1.08 (or up 13.6%) the next day. for the second signal, price went up from $0.94 to $1.12 (or up 19%) in 7 trading days, for both calls i made, price almost shot up immediately.

Below are the screenshot of the 2 live trading calls i sent out to fellow traders:

Below are the screenshot of the 2 live trading calls i sent out to fellow traders:

I would say it is fortunate to successfully avoid the severe sell down of YZJ and later caught the 2 good entry points for yzj and enjoy fast move of the price with low risk, all attribute to Game Theory trading.

Now YZJ has rebounded a lot already, what should we do thereafter? This is also many market participants asked me via all kinds of contacts, HP, email, whatsapp, investingnote.

This is how i read and plan my trades for YZJ for the time being:

First, it has rebounded quickly in the past 1 week plus, i won't think it is a good idea to chase already, the risk is much higher than my entry a week plus ago. although i feel yzj is likely to rebound some more, i will say the risk reward ratio is lousy now, not advisable to open new long position. If you really still bullish on yzj, better only trade very small position with a tight stop loss plan, and prepare to sell once it start to show weakness.

However for those already have YZJ position in hand, may consider to hold the position a bit longer as I feel the price may rebound some higher, may rebound to 1.2-1.25 level or even a bit higher, so i myself will only start to sell when price begin to show some weakness.

in terms of the very long term view, YZJ already turned to a long term downtrend stock after the severe sell down in July to Aug. After a good rebound, it is likely to drop again, therefore it may not be a good idea to close eye and hold long term for YZJ. Again "prepare and start to sell once it start to show weakness" maybe a better idea to take most out from the current nice rebound and avoid been caught by the possible long term downtrend.

Hope my analysis from Game Theory can help some mkt participants to maximize profit while minimize the potential risk in terms of trading Yangzijiang thereafter.

Now YZJ has rebounded a lot already, what should we do thereafter? This is also many market participants asked me via all kinds of contacts, HP, email, whatsapp, investingnote.

This is how i read and plan my trades for YZJ for the time being:

First, it has rebounded quickly in the past 1 week plus, i won't think it is a good idea to chase already, the risk is much higher than my entry a week plus ago. although i feel yzj is likely to rebound some more, i will say the risk reward ratio is lousy now, not advisable to open new long position. If you really still bullish on yzj, better only trade very small position with a tight stop loss plan, and prepare to sell once it start to show weakness.

However for those already have YZJ position in hand, may consider to hold the position a bit longer as I feel the price may rebound some higher, may rebound to 1.2-1.25 level or even a bit higher, so i myself will only start to sell when price begin to show some weakness.

in terms of the very long term view, YZJ already turned to a long term downtrend stock after the severe sell down in July to Aug. After a good rebound, it is likely to drop again, therefore it may not be a good idea to close eye and hold long term for YZJ. Again "prepare and start to sell once it start to show weakness" maybe a better idea to take most out from the current nice rebound and avoid been caught by the possible long term downtrend.

Hope my analysis from Game Theory can help some mkt participants to maximize profit while minimize the potential risk in terms of trading Yangzijiang thereafter.

Some investors missed both YZJ nice rebound, some investors may feel challenging in stock pick and price monitoring to catch nice great trading opportunities, like YZJ and other stocks (click here to read other trading calls made). If you encounter similar challenge in the market......

RSS Feed

RSS Feed