While most of investors are look for buying opportunities for Nanofilm, On 28 Apr (Thur), during my seminar, I made a trading idea(sell short) regarding NanoFilm, to short sell when price rebound ard $2.71-2.74, ard 10:17 PM. After that, price for Nanofilm, rebounded a bit and hit my entry price, then started dropping quickly, on 13 May, it already dropped to $2.35, a potential profit of 13.3%, in less than 2 weeks later.

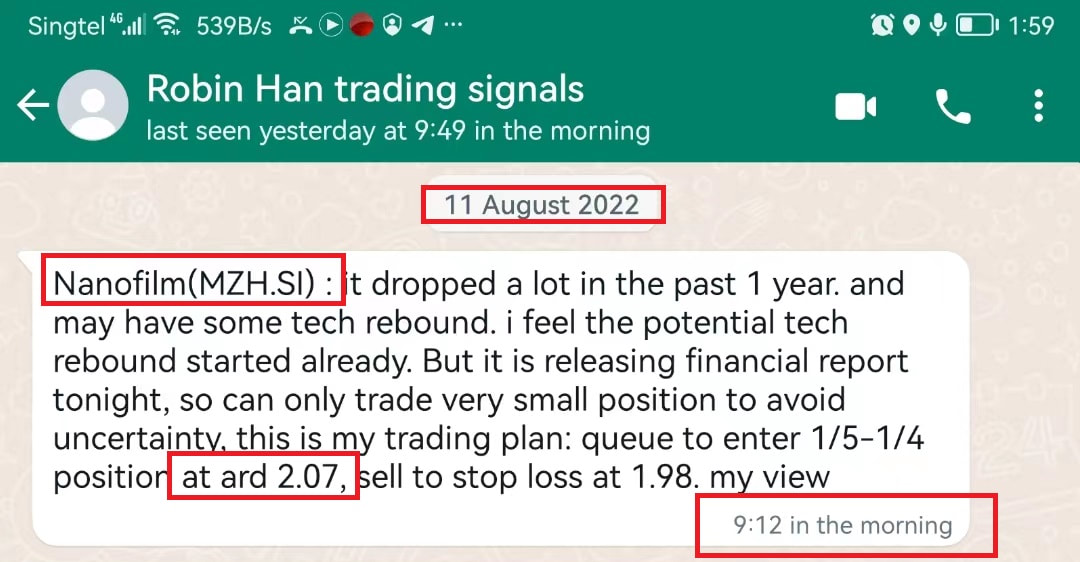

Below is the trading call I made for Nanofilm on 28 Apr, during seminar:

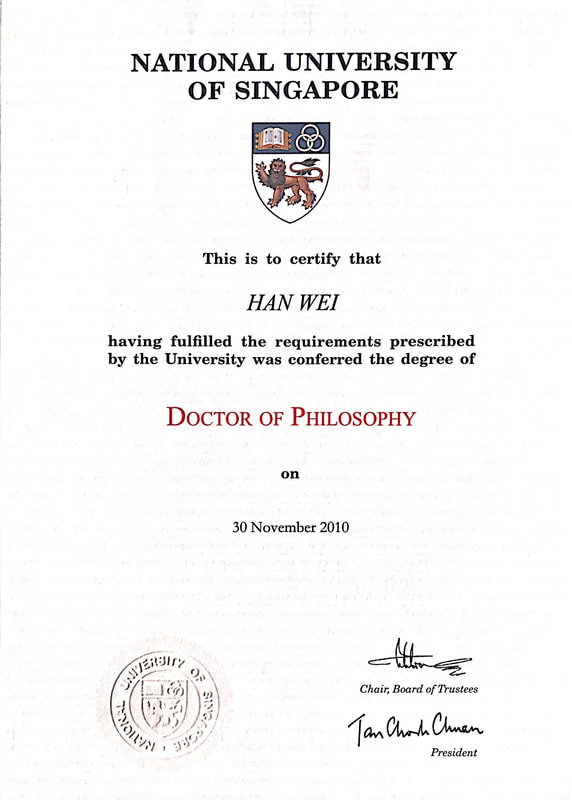

Nanofilm is a hot stock after its IPO for quite some time. IPO price was $2.59, and price once climbed to 6.67, which was a 157% rally and attracted a lot of attention in the market. But after that, it started turning weak and the price kept going down. Since price dropped below $4, many investors started looking at this stock, most of them want to bottom-fish while Dr.Han reminded investors to be cautious of sell down for Nanofilm long ago

Congrats to members who caught this opportunity according to Dr.Han live trading signals! Now many are asking whether the price can drop further after price has been dropped so much, whether can buy already. Below is his view:

According to my fund flow analysis, so far there is no clear sign of in-flow fund,therefore from mid to long term perspective, the price is likely to drop some more in fluctuation. For those who are holding short positions for long term, may consider to hold further. However short term wise, nanofilm already dropped a lot and have become oversold, there may be a short term rebound on the way. For those who do not want to trade short term or feel current price is low already, may consider close short position or at least close partial.

For myself, I have closed my short position for nanofilm to avoid the risk of short term rebound instead of holding the position to go through a lot fluctuation.From my point of view, if you have the ability to find low risk trading opportunities and are capable of finding the right entry timing, it is a better idea to allocate funds into stocks that may potentially fast soon, rather than to waste time in sleeping stocks.

According to my fund flow analysis, so far there is no clear sign of in-flow fund,therefore from mid to long term perspective, the price is likely to drop some more in fluctuation. For those who are holding short positions for long term, may consider to hold further. However short term wise, nanofilm already dropped a lot and have become oversold, there may be a short term rebound on the way. For those who do not want to trade short term or feel current price is low already, may consider close short position or at least close partial.

For myself, I have closed my short position for nanofilm to avoid the risk of short term rebound instead of holding the position to go through a lot fluctuation.From my point of view, if you have the ability to find low risk trading opportunities and are capable of finding the right entry timing, it is a better idea to allocate funds into stocks that may potentially fast soon, rather than to waste time in sleeping stocks.

Did you miss this Nanofilm shorting opportunity? or you feel hard to do stock pick and market monitoring to catch nice great trading opportunities, like Nanofilm shorting and other stocks (click HERE to read other trading calls made) ? If you would like to receive trading ideas for great stocks like Nanofilm shorting and improve your performance in future......

RSS Feed

RSS Feed