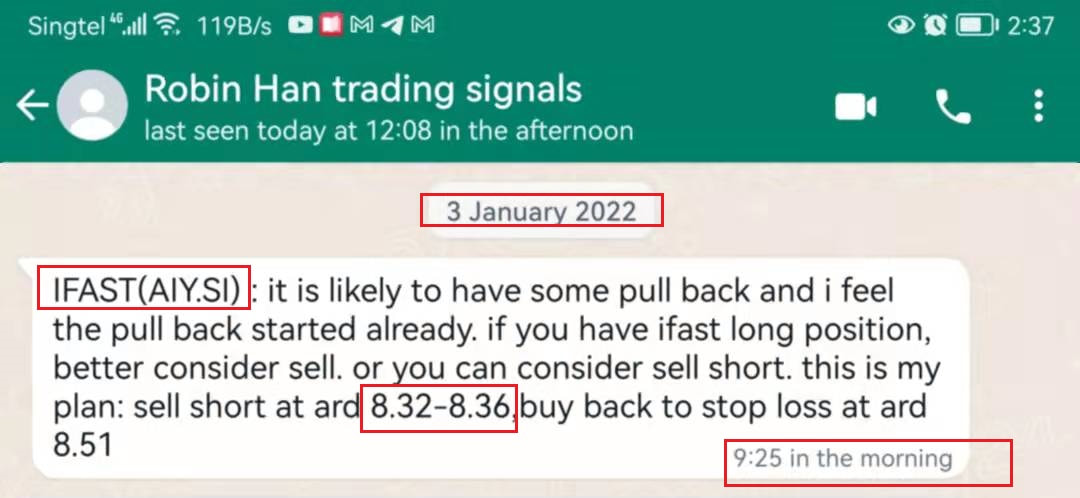

On 03 Jan (Mon), I sent out a live trading idea(sell short) to my members regarding Ifast at ard $8.32, ard 9:25 AM. after that, price rebound for one day then start to drop quickly, on 11 Jan, 5 trading days later, it already dropped to $7.31, a potential profit of 12.2%, just 1 week later.

below is the live trading idea to short ifast:

below is the live trading idea to short ifast:

Congrats to members who caught this opportunity according to my live trading signals. Now many are asking whether the price can drop further after price has been dropped so much, whether can short more. Below is my view:

Ifast is in a downtrend. My Bigboy fund flow indicator RHBI shows above that there is no significant fund flow(RHBI indicator circled in green is red color) to be pumped in although price rebounded on 12 Jan. Therefore, the downtrend remains. After the short term sell down momentum turn weak, I feel one should NOT short it any more. A mid term consolidation is likely to happen thereafter. On the other hand, as ifast financial situation is still good from fundamental perspective. It may not be a good idea to hold a long term short position on this counter. So for those who already have ifast short position and in profit, I will suggest to consider cover back to take profit and monitor whether got other shorting opportunities after consolidation.

Do you want to learn how to catch stocks that can gain 10% or more within a week, like Ifast?

Register the upcoming stock seminar in Chinese. Click the link below to register:

https://bit.ly/3F4JOFe

Register the upcoming stock seminar in Chinese. Click the link below to register:

https://bit.ly/3F4JOFe

RSS Feed

RSS Feed