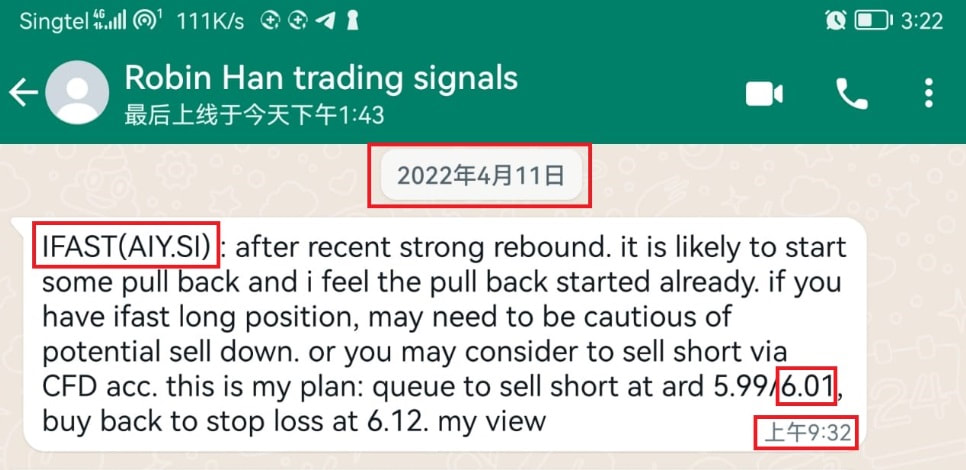

On 11 Apr, I sent out a live trading idea(short call) to my members regarding iFast Corporation at ard $5.99, ard 9:32 AM. After that, price has sold down gradually and reached 4.65 on 11 Feb, or -22.3% potential profit, in just 3 weeks later.

Below is the live trading call I made for iFast Corporation on 11 Apr, in the morning:

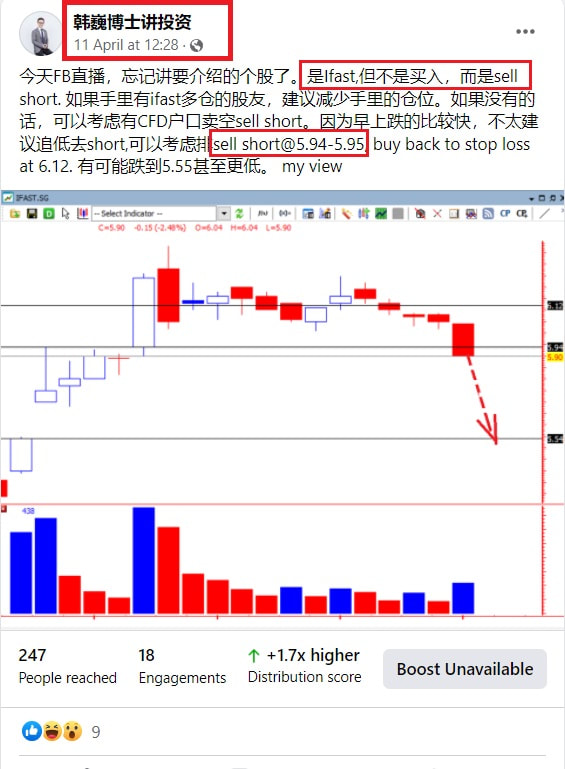

Below is the live trading call I made for iFast Corporation on 11 Apr on facebook, at noon:

Congrats to members who caught this opportunity according to my live trading signals! Now many are asking whether still can short or whether can hold the short position. Below is my view:

Funds are still flowing out for this stock so far. For short term, it may have some rebound but later may drop again. So if you are doing long-term investors for shorting, may consider continuing to hold short positions.

but for most trader/investors, considering that it suffered severe sell down in the past 2 weeks, there are even some panic selling, Usually after this panic, there is a good chance that there may be some technical rebound thereafter, so investors who already hold short selling in this case may consider buying back partial of shorting position(cover back partial position), to take at least partial profit, and to avoid strong rebound to eat up profits already made.

There are many investors who are concerned that the price is very low now, want to catch bottom and hoping the price to go up to 7-8 dollars or even higher. My view on this view is that there is no clear sign of inflow funds so far. The most possible senario is more likely to be a technical rebound, which is not particularly appropriate for the long term. But if some investors say that the long-term attempt to catch the rally to do a short period of time to sell take profit, this can be considered.

Funds are still flowing out for this stock so far. For short term, it may have some rebound but later may drop again. So if you are doing long-term investors for shorting, may consider continuing to hold short positions.

but for most trader/investors, considering that it suffered severe sell down in the past 2 weeks, there are even some panic selling, Usually after this panic, there is a good chance that there may be some technical rebound thereafter, so investors who already hold short selling in this case may consider buying back partial of shorting position(cover back partial position), to take at least partial profit, and to avoid strong rebound to eat up profits already made.

There are many investors who are concerned that the price is very low now, want to catch bottom and hoping the price to go up to 7-8 dollars or even higher. My view on this view is that there is no clear sign of inflow funds so far. The most possible senario is more likely to be a technical rebound, which is not particularly appropriate for the long term. But if some investors say that the long-term attempt to catch the rally to do a short period of time to sell take profit, this can be considered.

Did you miss this Ifast shorting opportunity? or you feel hard to do stock pick and market monitoring to catch nice great trading opportunities, like Ifast shorting and other stocks (click HERE to read other trading calls made) ? If you would like to receive trading ideas for great stocks like Ifast shorting and improve your performance in future......

RSS Feed

RSS Feed