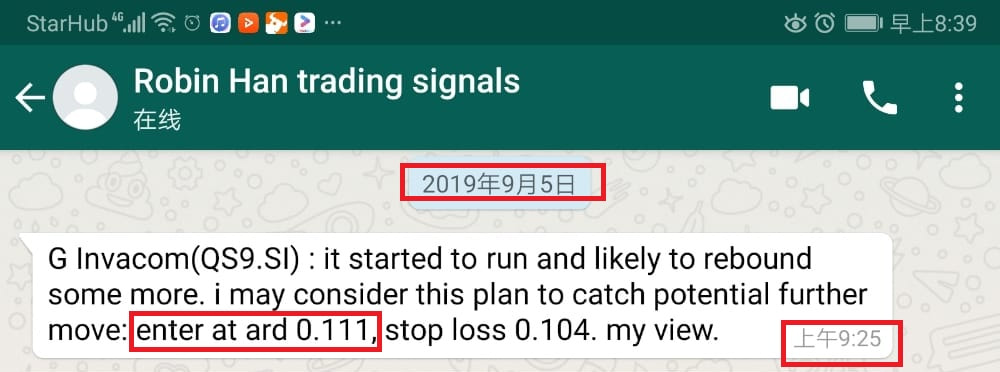

G invacom was mentioned for long on 5 Sept 2019 at ard 0.111 (refer to the screenshot of the live trading call below) and start to go up thereafter, it reached 0.127 on 13 Sept, a potential profit of 14.4% within 7 trading days, for those who received the live trading call via whatsapp, Congrats!

on the whatsapp live trading signal, I did not explain in detail on spot why I made that call at that timing is because it is timing consuming to explain in detail and good stocks usually do not wait for you. I often explains how I caught good trading signals during my exclusive client seminars.

After the nice move, some started to ask me questions like “can hold further?”, “I did not take action upon receiving your signal, can I buy now”

I would like to share my view for G invacom here:

Recent half year financial report released on 8 Aug was quite good: revenue up 30% and net profit up 200-300% for quarterly and half yearly results. It is no doubt that is a pretty good financial report and the stock is also in an uptrend. So for those who already have G invacom long position in hand, it is ok to stick to current position and expect the price to go up some more. I feel the price is likely to hit the one year high of 0.140 or even go higher given time.

However, regardless the good potential of the upside of G invacom, I will say after my trading call and went up 14.4%, to open new long position now may not be a good idea, at least for me because: the potential is only 0.013 (from current price of 0.127 to strong resistance at ard 0.140) while a reasonable stop loss should be 0.009-0.011, the risk to reward ratio is not attractive. can set a tighter stop loss? You can if you insist but you may also suffer whipsaw. After going up 25.7% recently(from recent low of 0.101 to 0.127), a pull back can happen anytime and a reasonable pull back will be ard 9 ticks or more, therefore tight stock loss of 7-8 ticks or lesser can easily end up with whipsaw.

So for those who is interested in G invacom but do not have long position yet, I will suggest to wait first until it form another good setup with low risk, then consider to enter at a much better risk to reward ratio.

After all, the market sentiment is good, it is not difficult for me to find another good rocket stocks (like those opportunities I caught before, Click HERE to read some other fast moving trading signals I caught) that move up fast with low risk, all attributing to Game Theory Trading skills I developed over years. Why bother to spend time and energy on a setup with not-very-good risk/reward ratio?

After the nice move, some started to ask me questions like “can hold further?”, “I did not take action upon receiving your signal, can I buy now”

I would like to share my view for G invacom here:

Recent half year financial report released on 8 Aug was quite good: revenue up 30% and net profit up 200-300% for quarterly and half yearly results. It is no doubt that is a pretty good financial report and the stock is also in an uptrend. So for those who already have G invacom long position in hand, it is ok to stick to current position and expect the price to go up some more. I feel the price is likely to hit the one year high of 0.140 or even go higher given time.

However, regardless the good potential of the upside of G invacom, I will say after my trading call and went up 14.4%, to open new long position now may not be a good idea, at least for me because: the potential is only 0.013 (from current price of 0.127 to strong resistance at ard 0.140) while a reasonable stop loss should be 0.009-0.011, the risk to reward ratio is not attractive. can set a tighter stop loss? You can if you insist but you may also suffer whipsaw. After going up 25.7% recently(from recent low of 0.101 to 0.127), a pull back can happen anytime and a reasonable pull back will be ard 9 ticks or more, therefore tight stock loss of 7-8 ticks or lesser can easily end up with whipsaw.

So for those who is interested in G invacom but do not have long position yet, I will suggest to wait first until it form another good setup with low risk, then consider to enter at a much better risk to reward ratio.

After all, the market sentiment is good, it is not difficult for me to find another good rocket stocks (like those opportunities I caught before, Click HERE to read some other fast moving trading signals I caught) that move up fast with low risk, all attributing to Game Theory Trading skills I developed over years. Why bother to spend time and energy on a setup with not-very-good risk/reward ratio?

Some investors missed this G invacom trading opportunity, some investors may feel challenging in stock pick and price monitoring to catch nice great trading opportunities, like G invacome and other stocks (click here to read other trading calls made). If you encounter similar challenge in the market......

RSS Feed

RSS Feed