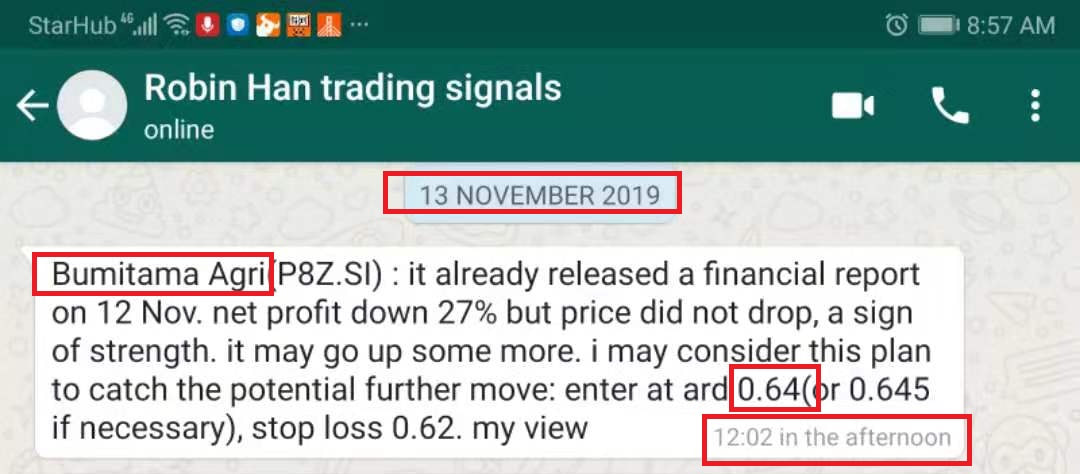

Bumitama was mentioned for long on 13 Nov at 0.64 when STI just started to pull back for this round and I just started to warn investors of the risk when STI still close to 3270-3280, the high for the previous round of rebound. After the trading call, Bumitama started a nice move.

From the chart above, it can be seen that, Bumitama kept showing strength thereafter: it almost never have severe pull back in between and the price went up from 0.64 to 0.765, a 19.5% potential profit in 1 month.

From the chart above, it can be seen that, Bumitama kept showing strength thereafter: it almost never have severe pull back in between and the price went up from 0.64 to 0.765, a 19.5% potential profit in 1 month.

Above is the live trading signal I sent out on 13 Nov BEFORE the nice move started. Congrats to those who follow my live trading signal and caught bumitama with a nice potential profit!

Now after the nice move, Bumitama started to attract attention. I started to receive SMS/whataspp or even phone calls asking about bumitama, whether it can go higher, whether can chase now, whether should sell.

Below is my view:

It is important to assess the trend for the stock first. After going up so much, when STI was weak in the past one month, I will say Bumitama is in an uptrend but short term is overbought already after going up from 0.700 to 0.765 in the past 3 days.

Because the overbought status may lead to a consolidation status soon or even a significant pull back, it is definitely not a good option to consider chase now, no matter how confident we are over the stock. Before we do any trading/investment, always ask how much risk I am taking and whether the potential profit is good enough to cover the risk. For this case, the risk/reward ratio is lousy for the time being.

But if you have bumitama position in hand and have profit already, it is ok to hold the position a big longer and see whether price can move up some higher. If it start to show some weakness, then consider sell partial by partial to take profit gradually on the first sign of weakness. Sometimes, short term strength can push price a lot, sometimes can push up to a level we never believe.

For long term investors, since the stock is in an uptrend, to hold long term can be a option for you, IF and ONLY IF you put a lot effort to study the fundamental of the company and feel very confident about its long future. for myself, since I have not did a deep study on the business and long term growth so far, I will not consider hold it for long term.

Now after the nice move, Bumitama started to attract attention. I started to receive SMS/whataspp or even phone calls asking about bumitama, whether it can go higher, whether can chase now, whether should sell.

Below is my view:

It is important to assess the trend for the stock first. After going up so much, when STI was weak in the past one month, I will say Bumitama is in an uptrend but short term is overbought already after going up from 0.700 to 0.765 in the past 3 days.

Because the overbought status may lead to a consolidation status soon or even a significant pull back, it is definitely not a good option to consider chase now, no matter how confident we are over the stock. Before we do any trading/investment, always ask how much risk I am taking and whether the potential profit is good enough to cover the risk. For this case, the risk/reward ratio is lousy for the time being.

But if you have bumitama position in hand and have profit already, it is ok to hold the position a big longer and see whether price can move up some higher. If it start to show some weakness, then consider sell partial by partial to take profit gradually on the first sign of weakness. Sometimes, short term strength can push price a lot, sometimes can push up to a level we never believe.

For long term investors, since the stock is in an uptrend, to hold long term can be a option for you, IF and ONLY IF you put a lot effort to study the fundamental of the company and feel very confident about its long future. for myself, since I have not did a deep study on the business and long term growth so far, I will not consider hold it for long term.

Did you miss this Bumitama opportunity? or you feel hard to do stock pick and market monitoring to catch nice great trading opportunities, like Bumitama and other stocks (click HERE to read other trading calls made) ? If you would like to receive trading ideas for great stocks like Bumitam and improve your performance in future......

RSS Feed

RSS Feed