Yesterday afternoon, Breadtalk started to show some strength and I made a call at ard 0.56/0.565. After that, it started to run almost immediately, jumped up to 0.645 within the same day, a 14.1% potential profit, within 1.5 hrs.

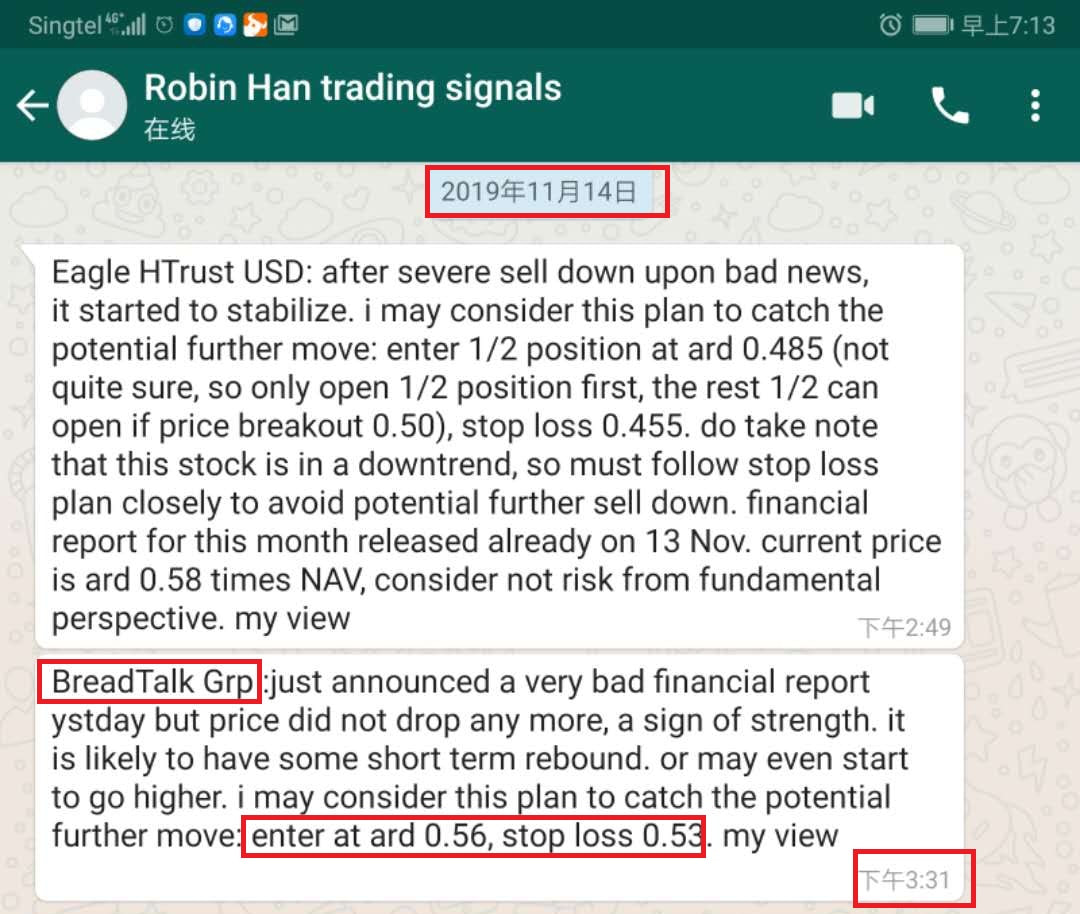

Below is the screenshot of my live trading call, BEFORE the ROCKET move started:

Below is the screenshot of my live trading call, BEFORE the ROCKET move started:

The fantastic movement really caught a lot attention and Breadtalk ranked #6 in the whole local mkt terms of trading volume (without warrant) yesterday. This is a huge volume for Breadtalk. The average trading volume for the past 10 trading days was 1.3M while yesterday surprisingly surged to 29M. Even if we do not count the married deal of ard 20M, the trading vlm of 9M is also considered a 590% increase.

If look at the financial report released on 13 Nov, the group did not perform well in the last quarter: net profit dropped 81%. However, if we look into detail of the financial report, we can find that earnings up10.1%, gross profit up 29.9%. The severe drop in terms of net profit mainly comes from adoption of new SFRS(I) 16 leases. So generally, the group is kind of turning around. This may be explain why price did not suffer sell down upon the release of 81% drop in net profit.

Now after yesterday great move, Breadtalk caught even more attention, I receive a lot sms/phone calls asking whether still can buy Breadtalk, when to sell existing positions with a quick profit. Below is my personal view for Breadtalk for the time being:

First and foremost, before yesterday ROCKET move, breadtalk was still in a downtrend. But the double bottom pattern formed in the past 2 weeks may turn out to be the long term bottom later. The climax volume yesterday is sign of inflow institutional funds because it is impossible for retailers to generate such a quick movement. In addition, the fantastic movement and climax volume will also attract attention of many retail investors, later price drop to the recent low at 0.53-0.55 again, many retail investor will try to bottom fish and therefore support the price. In addition, the adoption of new SFRS(I) 16 leases is a one time event, if most of its outlet remains similar earning ability, we are likely to see a nice growth in terms of net profit next quarter. Therefore the long term bottom of breadtalk may have been formed already, at ard 0.53.

However, for short term, the ROCKET move may incur some profit taking action. Although short term momentum may push the price to higher level, it is not advisable to chase now because those who bought at ard 0.53-0.54 already have a paper profit of 16-18% and may take profit any time and therefore may trigger the potential pull back soon.

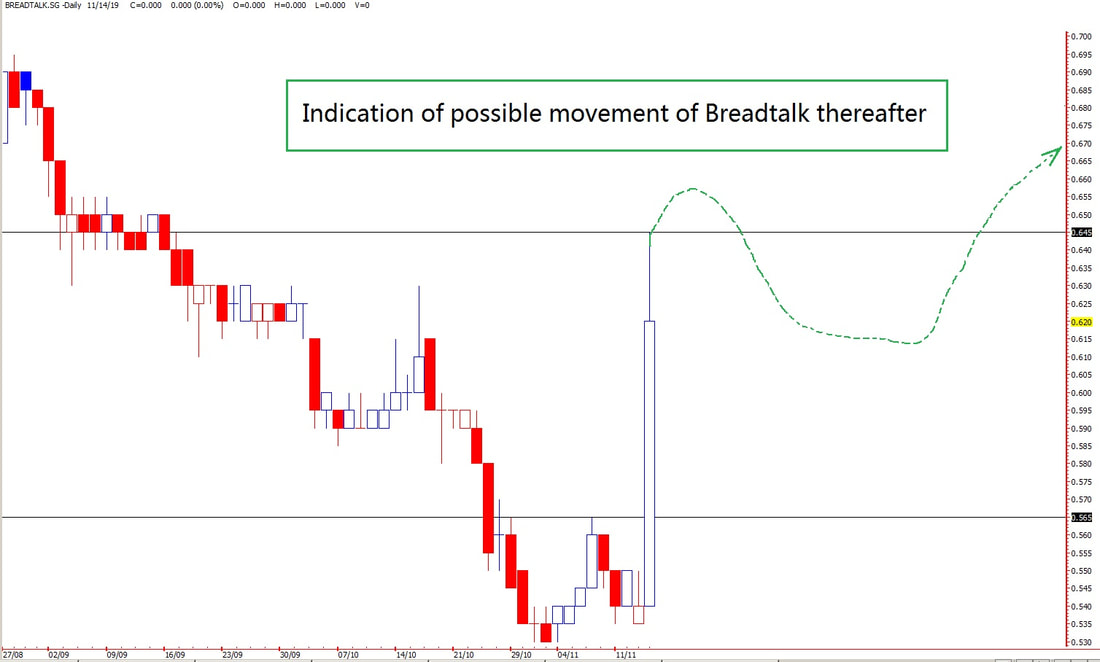

Below is this indicative possible movement of Breadtalk thereafter:

If look at the financial report released on 13 Nov, the group did not perform well in the last quarter: net profit dropped 81%. However, if we look into detail of the financial report, we can find that earnings up10.1%, gross profit up 29.9%. The severe drop in terms of net profit mainly comes from adoption of new SFRS(I) 16 leases. So generally, the group is kind of turning around. This may be explain why price did not suffer sell down upon the release of 81% drop in net profit.

Now after yesterday great move, Breadtalk caught even more attention, I receive a lot sms/phone calls asking whether still can buy Breadtalk, when to sell existing positions with a quick profit. Below is my personal view for Breadtalk for the time being:

First and foremost, before yesterday ROCKET move, breadtalk was still in a downtrend. But the double bottom pattern formed in the past 2 weeks may turn out to be the long term bottom later. The climax volume yesterday is sign of inflow institutional funds because it is impossible for retailers to generate such a quick movement. In addition, the fantastic movement and climax volume will also attract attention of many retail investors, later price drop to the recent low at 0.53-0.55 again, many retail investor will try to bottom fish and therefore support the price. In addition, the adoption of new SFRS(I) 16 leases is a one time event, if most of its outlet remains similar earning ability, we are likely to see a nice growth in terms of net profit next quarter. Therefore the long term bottom of breadtalk may have been formed already, at ard 0.53.

However, for short term, the ROCKET move may incur some profit taking action. Although short term momentum may push the price to higher level, it is not advisable to chase now because those who bought at ard 0.53-0.54 already have a paper profit of 16-18% and may take profit any time and therefore may trigger the potential pull back soon.

Below is this indicative possible movement of Breadtalk thereafter:

So for those who has not bought Breaktalk, to chase high at ard 0.63 is not a safe strategy. I think may wait for some pull back and start to accumulate progressively during pull back once price stabilized. For those who already open Breadtalk position and have profit, I think need to consider take profit or at least partial during strength to avoid possible pull back. We never know how deep the pull back can be, if pull back to 0.56 to below again, we can return a lot profit.

If you are very bullish on Breadtalk for long term, I think at least should consider close half of your position in profit once the momentum start to turn weak. After all, nothing can be guaranteed in the market, since price is likely to have some pull back soon and we don’t know how deep and how long will the pull back takes, to protect at least partial profit from uncertainty is necessary.

If you are very bullish on Breadtalk for long term, I think at least should consider close half of your position in profit once the momentum start to turn weak. After all, nothing can be guaranteed in the market, since price is likely to have some pull back soon and we don’t know how deep and how long will the pull back takes, to protect at least partial profit from uncertainty is necessary.

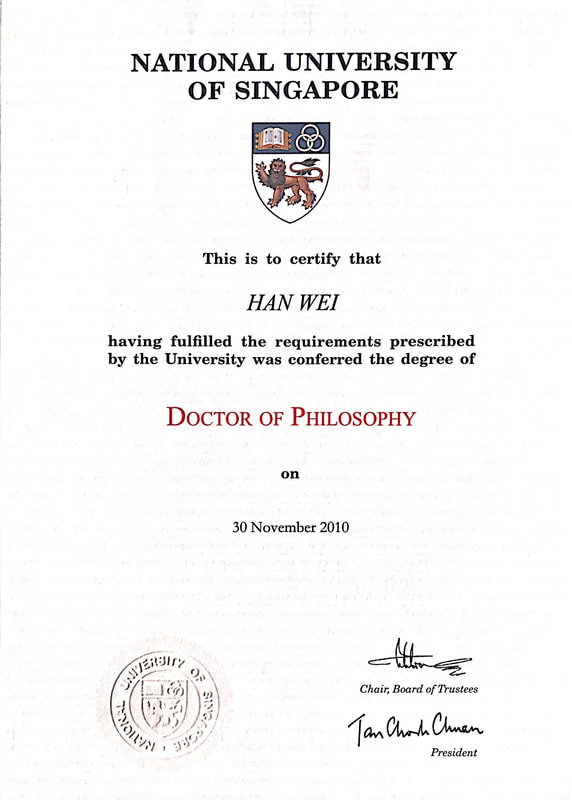

Did you miss this BREADTALK ROCKET move? or you feel hard to do stock pick and price monitoring to catch nice great trading opportunities, like BREADTALK and other stocks (click HERE to read other trading calls made) ? If you would like to receive trading ideas for great stocks like BREADTALK and improve your performance in future......

RSS Feed

RSS Feed